Maybe you only have one resolution this year. Maybe you have a laundry list of resolutions and a goal of being so self-actualized your friends and family will hardly recognize you! Maybe your resolution is to not have a resolution.

1. Set A Goal (and Write It Down)

Goal setting gives you direction. You can decide on your destination and make a plan to get there. This might seem small, but it’s not. Not only is goal setting found to be linked to higher achievement and self-confidence, but writing down your goal can also make you 42% more likely to succeed.

2. Get Clear

Getting clear on your priorities and deciding on a specific goal are two keys to success. When it comes to your money and your financial situation, set aside some time to reflect on what you really want to accomplish – and be specific.

Ask yourself three “W” questions:

- What do you want to accomplish?

- When will you achieve it?

- Why does it matter to you?

Visualizing a dollar amount can lead to success, whether it is a specific figure to save, pay off or earn in the year ahead. Keep that figure alive by writing it down or tracking it in an app. A real dollar amount makes for a real goal. Give yourself a deadline while you’re at it, to motivate you even further.

3. Be Positive and Realistic

Goals can challenge you and help you grow into a new future. Choosing a goal that is attainable is another important part of success. Let’s say you’ve chosen a clear goal – with a positive outcome – such as: “In five years, I will be debt free. I will pay off my entire debt of $12,000 so that I can focus on enjoying my family instead of worrying about money.” Be sure it’s a realistic goal given your specific situation. Given your income, debts and expenses, is it realistic to spend $200 on your goal each month? Is it possible to pay it off even faster by spending $250 a month? Or does your budget allow for $100? Staying positive and realistic shows you how much you can devote to achieving your money resolution.

4. Hit Those Milestones

Making your goal measurable will help it stick. Keeping track of your progress can help you stay focused and motivated. Tracking progress on an app or spreadsheet, or a simple notebook, helps you see your future getting closer and closer. Break your goal into smaller milestones. This makes it easier to see your progress and it’s less intimidating. For example, a mini-resolution might be to pay off one consumer credit card. Making smaller changes over time is often easier than trying to make a massive change all at once. Celebrate your success along the way. Celebrating wins actually “trains your brain” by reinforcing your new habits, which in turn makes it easier to stay on track if you hit a bump in the road at some point.

5. Make (and Work) The Plan

Money resolutions often go by the wayside if they serve as a goal without a plan. A plan outlines how you will accomplish your goal. Keep it simple. The plan might dearly define how much you will spend toward your goal, how often you’ll make deposits on it, and the method you’ll use to transfer money toward your goal. For instance, automating monthly payments or savings goals is proven to help people stick with money resolutions.

Choose one habit at a time to change. For example, if you need to reduce your credit card spending, focus on making that change as your first milestone. Then move on to setting money aside for payoff.

Ready to Make Money Resolutions That Stick?

The New Year is your opportunity for success. Our partners at GreenPath Financial Wellness offer free financial counseling and education. Their caring counselors are ready to work with you for options to get out of debt and improve financial wellness.

This article is shared by our partners at GreenPath Financial Wellness, a trusted national non-profit.

Saving At Any Age — America Saves Week

Saving. Do you view it as an ongoing journey? Or do you consider saving as someplace you arrive at? At America Saves we are in the camp that saving is a habit, not a destination. And it’s a habit that can be formed at any age. Whether you are a parent trying to instill this habit in your children or you want to change your own saving behaviors, there are strategies that savers of all ages can develop.

Research tells us that children’s money habits are often formed by age seven so starting early to teach them about saving can have a huge impact. Many parents are accustomed to hearing frequent requests from their children about a toy, game, or piece of clothing that they “just have to have.” Sound familiar? Using these wants is a great way to help children learn to save.

Children can learn to set a saving goal and figure out how long it will take to save enough money for their goal. Create a fun system to track progress, provide regular encouragement, and use incentives such as matching funds. Talk about how it feels to see your money grow. And don’t forget to lead by example – show children how you are saving.

You can also give children the opportunity to make some decisions about their money. Empowering children from a young age to make choices about money they earn or receive as gifts is a great way to build that confidence.

For young adults, as they begin to earn a regular and potentially higher income, a strong foundation begins with basic understanding of the difference between needs and wants. The America Saves Spending and Saving Tool is an easy-to-use resource that provides a clear view of your finances and can be insightful in identifying essential and discretionary spending. The system of automatic saving, especially through paychecks with split deposit, can set young adults on the path to a lifelong saving habit.

It can be hard to stay motivated when setting aside money for something in the future no matter what your age. It’s easy to focus on what you want in the moment — we don’t want to wait to purchase that expensive pair of sneakers. We want to take a trip in the next three months. Retirement is so far off that it feels OK to spend more of your current income right now and catch up later. In each of these scenarios, we aren’t thinking about our future selves, just who we are and what we want today.

Thinking of our future self – what we will want, what we will be doing, what we will believe – is one way we can develop a saving mindset. Asking questions about our future selves helps us create a vision for our future. For example, consider:

- Where does your future self live?

- What does a typical day look like for your future?

- What hobbies does your future self enjoy?

- How much money does your future self earn?

Later go back and read your answers to see how they compare to the present. Having the ability to look ahead, even if it’s a short time in the future, is a great way to reinforce saving today for tomorrow. This exercise can be done at any age, even with children.

Journeys can take us on many different paths and saving journeys are no different. So stay with America Saves as you and your family embark on a new journey or resume one that encountered a detour. It’s never too late to #ThinkLikeASaver.

SafeAmerica Credit Union is here to help you on your savings journey. Check out all the Savings opportunities we have to offer.

4 Financial Resolutions You Can Accomplish Now

New Year’s resolutions are a mixed bag for many of us. On the one hand: personal betterment! On the other hand: methodical auditing of our refrigerator, checking account, and various vices. On the cusp of a fresh calendar year, we feel compelled to immediately transform our lives, but—as is the case with most good things—change takes time. This is especially true when it comes to financial goals. And in the aftermath of steep holiday spending, our goalposts can feel...far away.

Automate Your Savings.

Enroll In A 401(k).

Trim Subscriptions

Check Your Credit Report.

You can get a free report once a year from each of the three major consumer reporting companies (Equifax, Experian, and TransUnion.) This allows you to resolve errors or instances of identity theft—red flags you do not want creditors looking at when they are evaluating your application for loans and credit cards. With the exception of Experian, you will have to pay a fee if you want to see your credit score. There is often a way around this, as more than 170 financial institutions and 10 of the top credit card issuers provide free access to your FICO score (the most commonly used type of credit score).

How to Get Your Free Credit Report.

The Fair and Accurate Credit Transactions Act of 2003 (FACT Act) entitles you to receive a free copy of your credit report once a year from each of the reporting companies – Equifax, Experian, and TransUnion. The three companies have set up one central website, toll-free telephone number, and mailing address. You can request your free report either online, by phone or even mail by visiting www.AnnualCreditReport.com or calling 1-877-322-8228.

Free Webinar March 9 — Starting From Scratch: How To Build Credit

This free, one hour webinar is presented by GreenPath Financial Wellness

What do renting an apartment, getting a job offer, and car insurance rates all have in common? Your credit history could impact every one of these things (and more)! Credit is important for more than just getting a loan, although it impacts that too. If you know you need to build credit and aren’t sure how to do so without going into debt, this webinar will provide guidance and tools to start you down the path to building positive credit history. Whether you have never had any credit history or are looking to rebuild credit after an extended period without, this webinar will cover why it is important to build positive credit history and how to do so responsibly.

Click through each tab below to learn more.

This webinar will be recorded and a link will be sent out to all registrants after the webinar.

Click the red button below to register.

America Saves Week – Save to Retire

Retirement is one of those endeavors that fall into the “someday” category. When living your day-to-day life as a person in their 20s, 30s, and even your 40s and those everyday expenses pop up, it’s more difficult to save for something that is seemingly so far away. But as we all know — life comes at you fast. A 2020 survey by Charles Schwab of currently employed 401(k) plan participants found that saving enough for retirement continues to be a leading source of significant financial stress for all generations.

While studies show that 71 percent of Americans are adequately prepared for retirement, much of that includes receiving Social Security benefits under the current law. With Social Security payouts only scheduled to be paid at the full benefit amount through 2035, Millennials and Gen Z have to approach retirement from a different perspective — one that is diverse and doesn’t rely on Social Security benefits, if you can help it. The good news is that starting early allows you to reach your retirement goals more easily.

In today’s economy, we can’t overlook the fact that there are some people who are not making a fair living wage, making it difficult to save. But for those of us with the ability to save it’s important to understand that it’s never too late to start saving for retirement. Your future self will thank you!

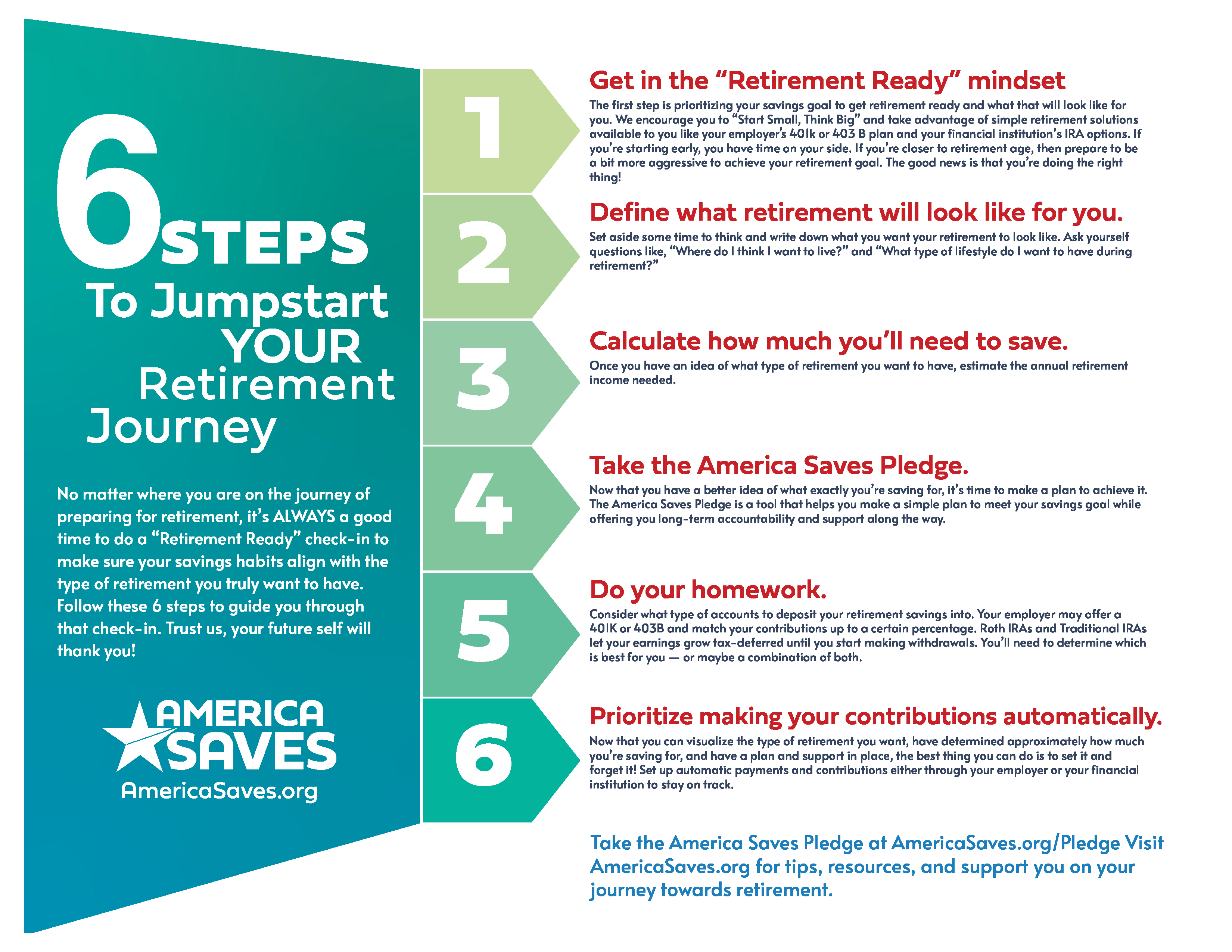

1. Get In The "Retirement Ready" Mindset

The first step is getting in the right mindset, meaning-making your new savings goal a priority. We encourage you to “Start Small, Think Big” and take advantage of retirement solutions available to you like your employer's 401K or 403 B plan or IRA options you can open on your own.

If you’re starting your retirement savings journey early, you have time on your side! However, if you’re closer to retirement age, then prepare to be a bit more aggressive in order to achieve your retirement goal. Research how to make catch-up contributions to your retirement savings, ultimately jump-starting a stalled plan.

The good news is this: it’s never too late! It is important to remember that saving anything is better than saving nothing. Even increasing your retirement savings by one percent can make a huge difference in the long run.

Your retirement years will be as individual as you are! Have you visualized how you’d like your retirement to look and feel? Think about where you want to settle down. Will you stay put and have sweet tea and lemonade on the front porch most days or do you intend to travel far and wide? Most importantly, how much “annual income” will you need to achieve this envisioned lifestyle? Asking yourself these questions will help determine a rough estimate of how much to start saving now.

Someone who plans to travel and or have an active lifestyle when they retire may need to save more than someone who has a home that is paid off with no grand plans of world travel.

You will also need to consider exactly when you want to retire. This will help determine how much you should be saving annually. In the modern age, people pre-retire, half-retire or even never leave the workforce at all.

3. Calculate How Much You'll need To Save

4. Take The America Saves Pledge

Now that you have a better idea of what exactly you’re saving for and how much, it’s time to consider how you’ll achieve your dream retirement. The America Saves Pledge is a tool that helps you make a simple plan to meet your savings goal while offering you long-term accountability and support along the way. Take the America Saves Pledge and visit AmericaSaves.org for tips, resources, and support on your journey towards retirement. Remember: savers who make a plan are twice as likely to save successfully!

5. Do Your Homework

Consider what type of accounts to deposit your retirement savings into. Your employer may offer a retirement plan such as a 401K, 403B, or SEP-IRA and match your contributions up to a certain percentage. The most important consideration here is to take advantage of any employer benefits such as matching your contributions up to a certain percentage. Find out if your employer offers a match and contribute at least enough to maximize that benefit.

Individual Retirement Arrangements (IRAs) are also an option, and you can open one anytime through financial institutions or financial services providers. There are several different IRAs including the most common: Roth and Traditional. Roth IRAs can be withdrawn at anytime without penalty and are tax-free. Traditional IRAs may be tax-deductible and your earnings grow tax-deferred until you start making withdrawals. You’ll need to determine which is best for you — or maybe a combination of both. The IRS has put together a great comparison tool to understand the differences between the two accounts and decide which may be better for you.

6. Prioritize Making Your Contributions Automatically

America Saves Week – Save for the Unexpected

The Coronavirus pandemic has made saving a priority for most Americans, especially those most vulnerable with low to moderate earnings. In fact, a recent study by Edelman Financial Engines, in conjunction with America Saves and the Bipartisan Policy Center, found that:

- 40% of working Americans report they had difficulty paying for a personal expense in 2020.

- 1 in 3 working Americans say they would run out of savings on hand in 1 month or less if their income suddenly stopped.

- Nearly 1 in 2 working Americans (45%) would have difficulty paying for a $400 emergency expense, meaning they say they would not cover it with savings or put it on their credit card and pay it off at the next statement; 11% say they would be unable to come up with the money.

While saving provides us with a much-needed financial cushion, it also helps ease the emotional burden of worrying about what’s around the corner.

Save for Opportunities

Day Two of America Saves Week encourages us to save for the unexpected. While saving for emergencies is always a much discussed topic in personal finances, here’s something that’s not as widely discussed: saving for opportunities.

If you are in the position to save, you’re not only saving for an unexpected car repair, medical bill, or appliance breaking down — you’re also saving for the last minute dinner invite with friends and family, the concert for your favorite artist, or the ability to grab a birthday gift for your child’s classmate.

Today we want you to consider reframing saving for the “dreaded emergency,” and recognize that you’re also saving for fun and positive opportunities! Doesn’t it feel better to contribute to an OPPORTUNITY FUND vs. an EMERGENCY FUND?

If you haven’t, we encourage you to take the America Saves Pledge. After making your new savings plan, you’ll receive support, reminders, and tips from America Saves that will help keep you on track towards achieving your goal.

America Saves Week – Save Automatically

It’s America Saves Week! We kick off day one of America Saves Week by focusing on the easiest and most effective way to save—AUTOMATICALLY.

How to Save Automatically

Automatic savings simply means you have a process in place to save at regular intervals, whether that’s monthly, weekly, or daily.

If you want to save automatically, we suggest one of these three strategies:

- Split to Save. Instruct your employer to direct a certain amount from your paycheck each pay period and transfer it to a retirement or savings account (or Both). Traditionally, you can set this up using your employer’s direct deposit, ask your HR representative for more details and set this up today. We call this method “Split to Save.”

- Auto-Transfer. Every payday, your bank or credit union transfers a fixed amount from your checking account to a savings or investment account. To set up automatic transfer with your SafeAmerica Credit Union accounts, simply log into Online Banking and click the TRANSFER link at the top of the page. You can set up transfers within your accounts here or with accounts you have elsewhere (external account).

- Scheduled Transfer. Choose a day of the month or a regular interval, such as every 2 weeks, to transfer a set amount from your checking account to a savings account. Consider picking a lower dollar amount or a time of the month when many other automatic payments aren’t happening. To set up a scheduled transfer with your SafeAmerica Credit Union accounts, log into Online Banking and click the Transfer link at the top of the page. You'll have the option to make your transfer a recurring one. Just set it and forget it!

Online Banking is a great way to save automatically. See how these tools can help you reach your goal! Click here!

If these methods don't work for you, you can still make saving a consistent habit!

- Save your loose change. Every day, put all of the loose change from your pocket or purse into a jar, and don’t spend it. If that jar starts to look tempting, take it to a local, federally insured bank or credit union to cash and deposit into a savings account with low to no fees. However, if you’ve got a big jar: there’s no harm in watching your automatic savings pile up- literally!

Why Automatic Savings Works

Over time, these automatic deposits add up. For example, $50 a month accumulates to $600 a year and $3,000 after five years, plus interest that has compounded. Soon you will be able to cover many unexpected expenses without putting them on your credit card or taking out a high-cost loan.

I Don't Have Enough Money To Save

If you’re still in the stage of your savings journey where you’re reducing debt (which is saving!), then visit our resources to help you pay down debt.

Remember, even while you’re actively reducing debt, everyone has the ability to start to save, even if it's a small amount. Remember to “Start Small, Think Big.” You can start with only a small amount, and you can save daily, weekly, or monthly. Over time, your deposits will add up. Even small amounts of savings can help you in the future.

Saving Automatically Flyer

Check out, print, or download the Saving Automatically Flyer. Then be sure to take the America Saves Pledge to get support, resources, and tips to help you along your savings journey based on what you are actually saving for!

How do you save automatically? The two best ways to save automatically are to split your direct deposit or have your financial institution automatically transfer a predetermined amount from your checking to savings. By saving automatically you’ll adopt a “set it and forget it” approach that increases your success. And remember, saving is a HABIT, not a destination.

How do you save automatically? The two best ways to save automatically are to split your direct deposit or have your financial institution automatically transfer a predetermined amount from your checking to savings. By saving automatically you’ll adopt a “set it and forget it” approach that increases your success. And remember, saving is a HABIT, not a destination.

America Saves Week – Building Financial Resilience – February 21 – 25, 2022

Join us for America Saves Week from February 21st to the 25th as we share tools and resources that inspire members and their families to save successfully and achieve better financial stability. Each day during America Saves Week focuses on a new theme regarding Building Financial Resilience and provides you with tips and tools to help you accomplish your financial goals. Be sure to follow us on social media to view new tips each day.

America Saves Week Daily Themes:

- Monday, February 21, 2022 | Save Automatically

- Tuesday, February 22, 2022 | Save For The Unexpected

- Wednesday, February 23, 2022 | Save To Retire

- Thursday, February 24, 2022 | Save By Reducing Debt

- Friday, February 24, 2022 | Save As A Family

Why You Should Participate in America Saves Week

By participating in America Saves Week, we can help you navigate through different areas of your finances that better position you for success. By the end of the week, you’ll learn about short term and long term savings goals (such as emergency funds and retirement), the best strategies for saving successfully (making a plan and saving automatically), and how to have healthy conversations and instill positive financial behaviors with your family.

About America Saves

America Saves is a non-profit organization that uses principles of behavioral economics and social marketing to motivate, encourage and support everyday Americans to save money, reduce debt, build wealth and create better financial habits. America Saves is an initiative of the Consumer Federation of America (CFA), a non-profit, pro-consumer organization of over 270 consumer education, advocacy, and cooperative members dedicated to advancing consumer interest.

America Saves encourages individuals and families to take the America Saves pledge, a tool that empowers you to commit to save successfully with a plan. Thousands of non-profit, government, and corporate organizations partner with America Saves through local, regional, statewide, and national campaigns both year-round and during America Saves Week. Learn more about America Saves Week.

Take The Pledge

Those with a savings plan are twice as likely to save successfully. Taking the America Saves Pledge is a pledge to yourself to start a savings journey and America Saves is here to encourage you along the way. Take the first step toward creating a better financial future. Make a plan, set a goal, and pledge to yourself to start saving, today. Complete the Pledge and America Saves will send you short email and text reminders, resources and tips to keep you on track towards your savings goal. Become part of an entire community of savers. Get started now!