Retirement is one of those endeavors that fall into the “someday” category. When living your day-to-day life as a person in their 20s, 30s, and even your 40s and those everyday expenses pop up, it’s more difficult to save for something that is seemingly so far away. But as we all know — life comes at you fast. A 2020 survey by Charles Schwab of currently employed 401(k) plan participants found that saving enough for retirement continues to be a leading source of significant financial stress for all generations.

While studies show that 71 percent of Americans are adequately prepared for retirement, much of that includes receiving Social Security benefits under the current law. With Social Security payouts only scheduled to be paid at the full benefit amount through 2035, Millennials and Gen Z have to approach retirement from a different perspective — one that is diverse and doesn’t rely on Social Security benefits, if you can help it. The good news is that starting early allows you to reach your retirement goals more easily.

In today’s economy, we can’t overlook the fact that there are some people who are not making a fair living wage, making it difficult to save. But for those of us with the ability to save it’s important to understand that it’s never too late to start saving for retirement. Your future self will thank you!

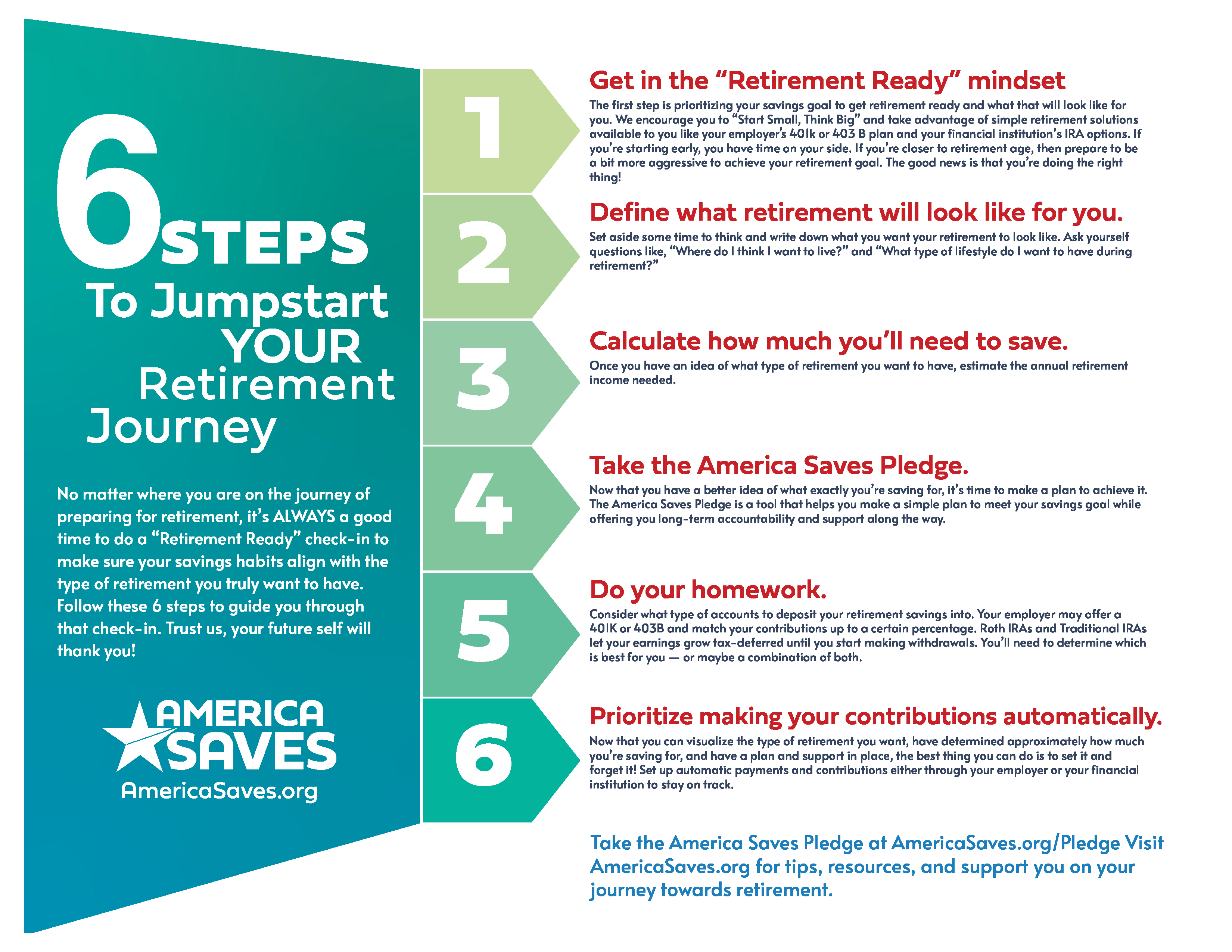

1. Get In The "Retirement Ready" Mindset

The first step is getting in the right mindset, meaning-making your new savings goal a priority. We encourage you to “Start Small, Think Big” and take advantage of retirement solutions available to you like your employer's 401K or 403 B plan or IRA options you can open on your own.

If you’re starting your retirement savings journey early, you have time on your side! However, if you’re closer to retirement age, then prepare to be a bit more aggressive in order to achieve your retirement goal. Research how to make catch-up contributions to your retirement savings, ultimately jump-starting a stalled plan.

The good news is this: it’s never too late! It is important to remember that saving anything is better than saving nothing. Even increasing your retirement savings by one percent can make a huge difference in the long run.

Your retirement years will be as individual as you are! Have you visualized how you’d like your retirement to look and feel? Think about where you want to settle down. Will you stay put and have sweet tea and lemonade on the front porch most days or do you intend to travel far and wide? Most importantly, how much “annual income” will you need to achieve this envisioned lifestyle? Asking yourself these questions will help determine a rough estimate of how much to start saving now.

Someone who plans to travel and or have an active lifestyle when they retire may need to save more than someone who has a home that is paid off with no grand plans of world travel.

You will also need to consider exactly when you want to retire. This will help determine how much you should be saving annually. In the modern age, people pre-retire, half-retire or even never leave the workforce at all.

3. Calculate How Much You'll need To Save

4. Take The America Saves Pledge

Now that you have a better idea of what exactly you’re saving for and how much, it’s time to consider how you’ll achieve your dream retirement. The America Saves Pledge is a tool that helps you make a simple plan to meet your savings goal while offering you long-term accountability and support along the way. Take the America Saves Pledge and visit AmericaSaves.org for tips, resources, and support on your journey towards retirement. Remember: savers who make a plan are twice as likely to save successfully!

5. Do Your Homework

Consider what type of accounts to deposit your retirement savings into. Your employer may offer a retirement plan such as a 401K, 403B, or SEP-IRA and match your contributions up to a certain percentage. The most important consideration here is to take advantage of any employer benefits such as matching your contributions up to a certain percentage. Find out if your employer offers a match and contribute at least enough to maximize that benefit.

Individual Retirement Arrangements (IRAs) are also an option, and you can open one anytime through financial institutions or financial services providers. There are several different IRAs including the most common: Roth and Traditional. Roth IRAs can be withdrawn at anytime without penalty and are tax-free. Traditional IRAs may be tax-deductible and your earnings grow tax-deferred until you start making withdrawals. You’ll need to determine which is best for you — or maybe a combination of both. The IRS has put together a great comparison tool to understand the differences between the two accounts and decide which may be better for you.

6. Prioritize Making Your Contributions Automatically