It’s America Saves Week! We kick off day one of America Saves Week by focusing on the easiest and most effective way to save—AUTOMATICALLY.

How to Save Automatically

Automatic savings simply means you have a process in place to save at regular intervals, whether that’s monthly, weekly, or daily.

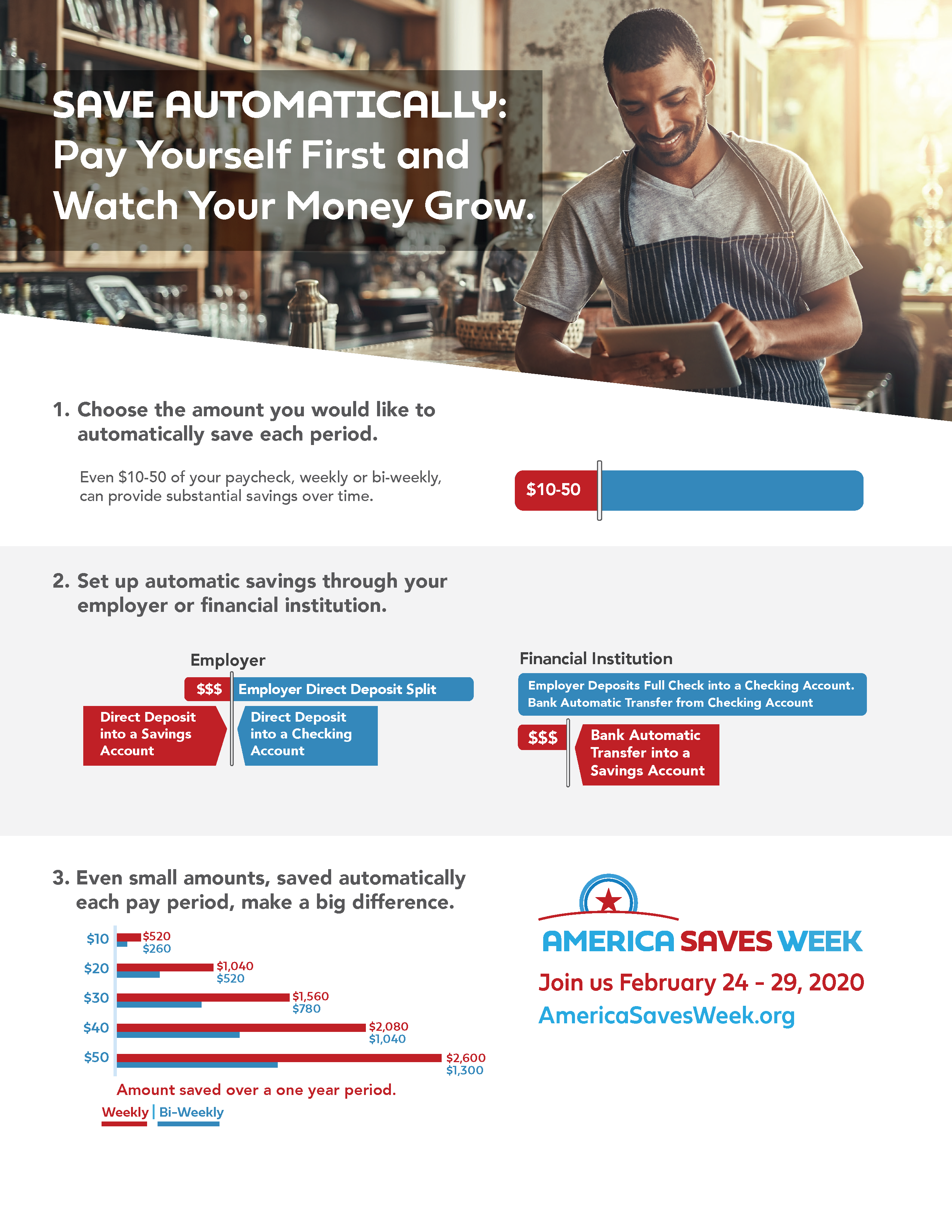

If you want to save automatically, we suggest one of these three strategies:

- Split to Save. Instruct your employer to direct a certain amount from your paycheck each pay period and transfer it to a retirement or savings account (or Both). Traditionally, you can set this up using your employer’s direct deposit, ask your HR representative for more details and set this up today. We call this method “Split to Save.”

- Auto-Transfer. Every payday, your bank or credit union transfers a fixed amount from your checking account to a savings or investment account. To set up automatic transfer with your SafeAmerica Credit Union accounts, simply log into Online Banking and click the TRANSFER link at the top of the page. You can set up transfers within your accounts here or with accounts you have elsewhere (external account).

- Scheduled Transfer. Choose a day of the month or a regular interval, such as every 2 weeks, to transfer a set amount from your checking account to a savings account. Consider picking a lower dollar amount or a time of the month when many other automatic payments aren’t happening. To set up a scheduled transfer with your SafeAmerica Credit Union accounts, log into Online Banking and click the Transfer link at the top of the page. You'll have the option to make your transfer a recurring one. Just set it and forget it!

Online Banking is a great way to save automatically. See how these tools can help you reach your goal! Click here!

If these methods don't work for you, you can still make saving a consistent habit!

- Save your loose change. Every day, put all of the loose change from your pocket or purse into a jar, and don’t spend it. If that jar starts to look tempting, take it to a local, federally insured bank or credit union to cash and deposit into a savings account with low to no fees. However, if you’ve got a big jar: there’s no harm in watching your automatic savings pile up- literally!

Why Automatic Savings Works

Over time, these automatic deposits add up. For example, $50 a month accumulates to $600 a year and $3,000 after five years, plus interest that has compounded. Soon you will be able to cover many unexpected expenses without putting them on your credit card or taking out a high-cost loan.

I Don't Have Enough Money To Save

If you’re still in the stage of your savings journey where you’re reducing debt (which is saving!), then visit our resources to help you pay down debt.

Remember, even while you’re actively reducing debt, everyone has the ability to start to save, even if it's a small amount. Remember to “Start Small, Think Big.” You can start with only a small amount, and you can save daily, weekly, or monthly. Over time, your deposits will add up. Even small amounts of savings can help you in the future.

Saving Automatically Flyer

Check out, print, or download the Saving Automatically Flyer. Then be sure to take the America Saves Pledge to get support, resources, and tips to help you along your savings journey based on what you are actually saving for!

How do you save automatically? The two best ways to save automatically are to split your direct deposit or have your financial institution automatically transfer a predetermined amount from your checking to savings. By saving automatically you’ll adopt a “set it and forget it” approach that increases your success. And remember, saving is a HABIT, not a destination.

How do you save automatically? The two best ways to save automatically are to split your direct deposit or have your financial institution automatically transfer a predetermined amount from your checking to savings. By saving automatically you’ll adopt a “set it and forget it” approach that increases your success. And remember, saving is a HABIT, not a destination.